RaQualia values the interests of all of our stakeholders. We believe in the importance of corporate governance in responding to these interests, enhancing our corporate value, and fulfilling the trust that has been placed in us. We have implemented the following internal controls in order to continuously strengthen our management structure, ensure quick and responsible decision making, and maintain a highly transparent and fair organization.

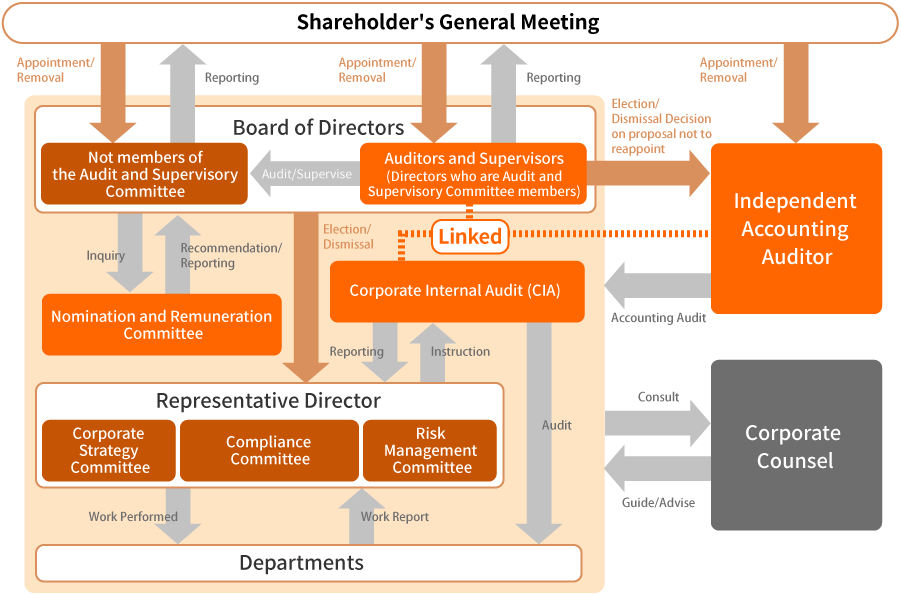

RaQualia maintains a Board of Directors (BOD), a Audit and Supervisory Committee, and a Corporate Internal Audit (CIA).

The BOD meets once per month for its regular meeting and also holds ad hoc meetings as needed. The Board deliberates and makes decisions regarding the company's management policy and annual budget, as well as providing reports on monthly budget administration and other important matters related to the company's operations. In order to strengthen the Board's monitoring functions, four of the seven Directors are appointed from outside the company.

The Audit and Supervisory Committee meets regularly and also holds ad hoc meetings as needed. The Committee is made up of three members with knowledge of venture businesses, including a lawyer and a tax accountant/certified public accountant, to enhance the audit system as well as to ensure the independence and transparency of the auditing work. The Audit and Supervisory Committee reports the results of audit activities to the Board of Directors in a timely manner. Furthermore, the Committee regularly exchanges opinions with the Representative Director and the accounting auditor respectively to supervise the execution of duties by the Directors.

To enhance the fairness, transparency, and objectivity of the procedures related to the nomination and remuneration of directors and to strengthen our corporate governance, RaQualia has established a Nomination and Remuneration Committee. In response to inquiries from the Board of Directors, the Committee deliberates on matters concerning the appointment and dismissal of Directors, the selection and dismissal of the Representative Director, matters related to Directors' remuneration, and other important management matters referred to the Committee by the Board of Directors, and provides recommendations or reports on its findings to the Board of Directors.

Comprising one manager who reports directly to the Representative Director, the Corporate Internal Auditor (CIA) is responsible for audits of all departments. The CIA conducts audits on the basis of the annual audit plan and submits a report summarizing the results of internal audits to the Representative Director. The CIA also submits reports to audited departments and advises them on how to effect improvements.

Audited departments promptly prepare responses addressing the matters requiring improvement and apply the findings of the internal audit to their operations.

The Corporate Strategy Committee, consisting of the Representative Director and the Corporate Officers, is an advisory board to support the work of the Representative Director and to provide a forum for focused discussions on management topics. The Committee meets weekly and holds ad hoc meetings as necessary in support of quick and appropriate decision making.

The Compliance Committee is composed of the Corporate Officers including the Representative Director, the Personnel Director and the Head of Audit Office. The Committee establishes compliance rules at meetings generally held once every six months. The Committee's main activities are to create a compliance regime, draft and maintain the compliance program, monitor the company's compliance with all laws and regulations, and implement compliance education and training for employees.

The Risk Management Committee comprises the company's Corporate Officers, including the Representative Director. The Committee makes decisions related to risk management and risk management rules, and generally meets once every six months. This Committee anticipates compliance risk, reputational risk, operational risk, disaster risk, and others types of risk and evaluates, responds to, manages, and provides information regarding these risks. The Committee considers policies and plans for responding to risks that may have a major impact on the company and diligently works to reduce the effect of all anticipated risks.

RaQualia has selected the firm of Ernst & Young ShinNihon LLC to serve as our independent accounting auditor. We consistently ensure that the auditing work is performed in a fair and impartial way, and we strive to provide fair and appropriate management and financial information.

Furthermore, the Audit and Supervisory Committee, the Corporate Internal Auditor (CIA) and our independent accounting auditor closely coordinate information-sharing in order to conduct their audit effectively and efficiently. The independent accounting auditor provides on audit reports and quarterly review reports.

From the perspective of corporate social responsibility and corporate defense, RaQualia recognize that the exclusion of antisocial forces is important in business issue.

We cut off any relationship with antisocial forces, including dealings and support, did not give in to unreasonable demands from antisocial forces, and suffered damage to business operations such as abuse and slander. In the case, we cooperate with related organizations such as the police,Center for Elimination of Organized Crime Groups and outside counsels and will do a resolute response.

In addition, in order to prevent or check transactions with anti-social forces, we will establish an internal system and conduct systematic responses to sever any relationship with these forces.