We brighten people’s lives through the power of innovation

To achieve this mission, we commit to pursue further growth as a biotechnology company with a focus on developing innovative medicines.

RaQualia is a research and development-centered biotechnology company that discovers innovative medicines for unmet medical needs. We focus on discovering novel pharmaceuticals through open collaboration with cutting-edge life science technologies. We license them out to pharmaceutical companies to expedite availability to patients.

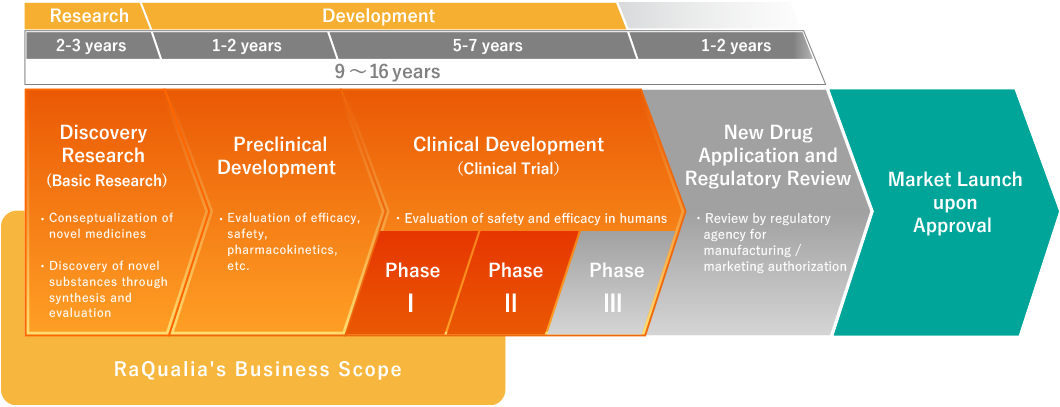

Generally, it takes more than a decade to bring a new drug to patients from drug discovery. The process begins with conceptualizing ideas for new drug candidates based on healthcare needs and basic research studies. In the exploratory research phase, these candidates are created through basic research activities such as synthesis and efficacy evaluation. Moving into the preclinical phase, the efficacy, safety, and pharmacokinetics of these candidates are evaluated in vitro and in vivo. Based on the data and findings, selected drug candidates proceed to clinical studies. In the clinical development phase, drug candidates are evaluated for safety and efficacy in patients. Finally, undergoing strict regulatory reviews, they are approved as new medications.

Read more details on research and development.

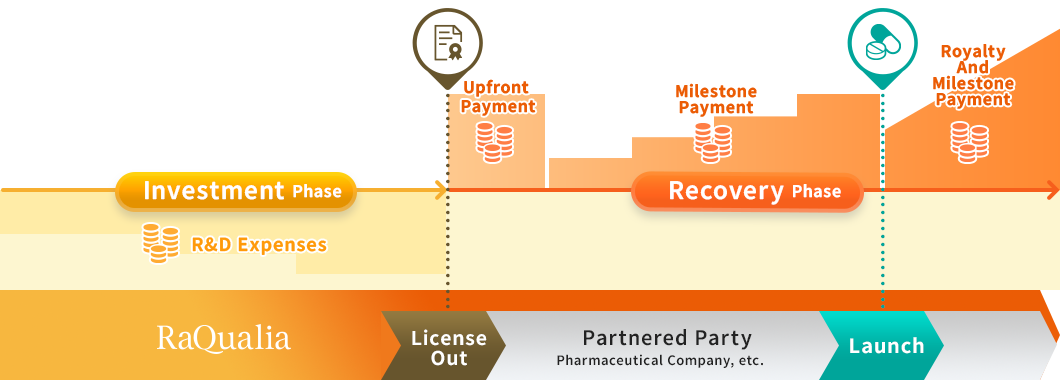

RaQualia operates as a research and development-centered biotechnology company, generating revenue by creating the seeds for novel medicine and licensing them to pharmaceutical companies.

Given that significant investment is required for drug development, there is a current trend where distinct roles are undertaken by biotechnology companies and pharmaceutical companies. Biotechnology companies like us, primarily focus on creating drug candidates, while pharmaceutical companies to which the drug candidates are licensed proceed with subsequent development and commercialization.

Licensing out of drug candidates is executed through contractual agreements with pharmaceutical companies that grant rights to develop, manufacture and commercialize the drug candidates. We receive the upfront payments and milestone payments based on the progress of the development stages along with royalties as part of the sales at the post-marketing stage of the products.

The value of a potential drug candidate increases with the progress of the development stages, we can obtain stable revenue after product launch. Once out-licensed, we will generate significant long-term revenues and recover the previous investment. This will facilitate reinvestment into new research and development activities, promoting more growth for our business.

Upfront Payment

Income received upon entering into a licensing agreement with pharmaceutical companies, etc.

Milestone Payment

Income received upon achieving certain milestones in development or upon reaching a certain level of sales post-product launch.

Royalty

Income received post-product launch based on a certain percentage of sales revenue.

Research Fund

Income received when undertaking research on behalf of contracting parties.

Not illustrated in the figure, as it occurs independently of specific research and development stages.

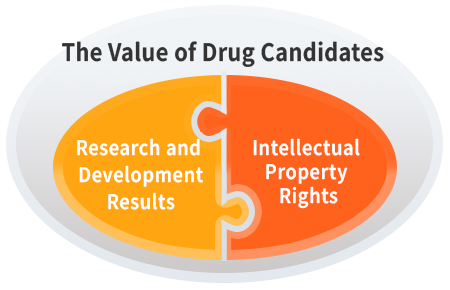

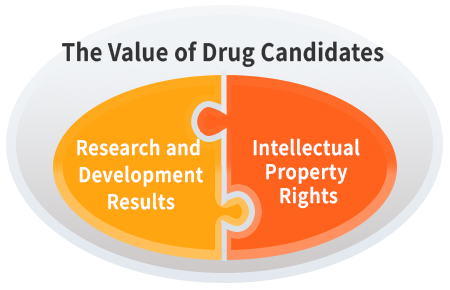

Licensing-out consists of granting intellectual property rights to third parties. The intellectual property strategy is important for our business of development and commercialization of new drugs.

We are committed to delivering innovative pharmaceuticals to patients, utilizing drug candidates we have discovered. To achieve this, strategies of intellectual property such as intellectual property acquisition for competitive advantage, value expansion through licensing, and lifecycle management of patents for patient benefit.

Licensing-out consists of granting intellectual property rights to third parties. The intellectual property strategy is important for our business of development and commercialization of new drugs.

We are committed to delivering innovative pharmaceuticals to patients, utilizing the seeds of novel drugs we have discovered. To achieve this, strategies of intellectual property such as intellectual property acquisition for competitive advantage, value expansion through licensing, and lifecycle management of patents for patient benefit.

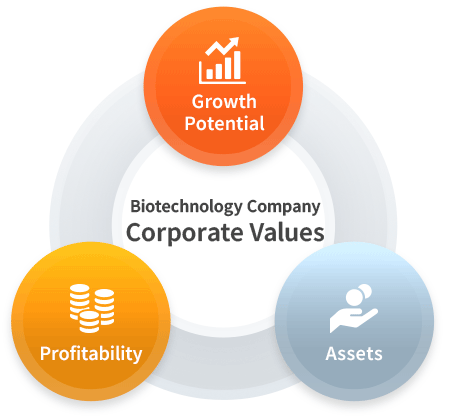

Several key factors contribute to determining corporate value include profitability, assets, and growth potential. However, predicting profitability and assets is challenging. Pharmaceuticals currently generating substantial revenue are expected to face a decline in value over time with the emergence of generic drugs. Conversely, it is also possible that one innovative medicine can yield 100 billion yen (approx. 120 billion USD) in annual revenue. Therefore, as a biotechnology company navigating the dynamic system, we recognize that the critical factor among them is growth potential.

The key to enhancing this growth potential lies in consistently producing groundbreaking drug seeds and maximizing the strength of intellectual property rights to the fullest extent.

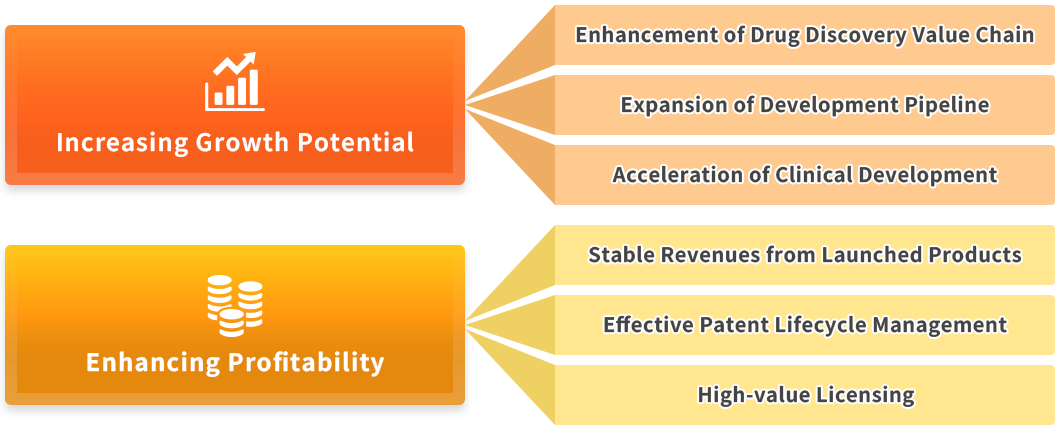

To unlock the growth potential, RaQualia focuses on expanding its development pipeline through strengthening the drug discovery value chain and consistently generating compelling drug candidates. We consider advancing our clinical development as one of the options to further enhance the value of our novel drug candidates.

Several key factors contribute to determining corporate value include profitability, assets, and growth potential. However, predicting profitability and assets is challenging. Pharmaceuticals currently generating substantial revenue are expected to face a decline in value over time with the emergence of generic drugs. Conversely, it is also possible that one innovative medicine can yield 100 billion yen (approx. 120 billion USD) in annual revenue. Therefore, as a biotechnology company navigating the dynamic system, we recognize that the critical factor among them is growth potential.

The key to enhancing this growth potential lies in consistently producing groundbreaking drug seeds and maximizing the strength of intellectual property rights to the fullest extent.

To unlock the growth potential, RaQualia focuses on extending its development pipeline through strengthening the drug discovery value chain and consistently generating compelling drug candidates. We consider advancing our clinical development as one of the options to further enhance the value of our novel drug candidates.

Stable revenue from our launched products constitutes a significant portion of our profits. However, to further enhance our corporate value, it is essential to concentrate not only on growth potential but also on expanding profitability. For this purpose, we aim to optimize revenue through close collaboration with partners and effective patent lifecycle management. Additionally, we aspire to secure high-value licenses from constant reinvestment on R&D.